Bookkeeping involves recording, classifying, and organizing every financial transaction in a business. In short, it gives you an overview of the financial health of your business.

Most small businesses do rudimentary bookkeeping. This prevents them from making data-backed financial decisions. That’s why it’s critical to conduct efficient bookkeeping for small businesses.

Read this guide to find out how to do bookkeeping for a small business.

Let’s start with the basics.

What is Bookkeeping & Why Do You Need it for Your Business?

Bookkeeping is an integral part of accounting that deals with recording and managing the day-to-day financial transactions of a business. It also organizes all the transactions that have happened since the opening of the business firm.

Bookkeeping for small businesses records the following metrics: sales earned revenue, payment of taxes, earned interest, payroll, and other operational expenses, loans and investments, etc.

Each transaction is registered with a support document—a receipt, invoice, purchase order, or similar financial records, depending upon the business.

Remember that bookkeeping and accounting are almost used interchangeably in the business landscape.

Although bookkeeping involves recording financial transactions whereas accounting involves interpreting, classifying, analyzing, reporting, and summarizing financial data.

Why Do You Need Basic Bookkeeping for Small Business?

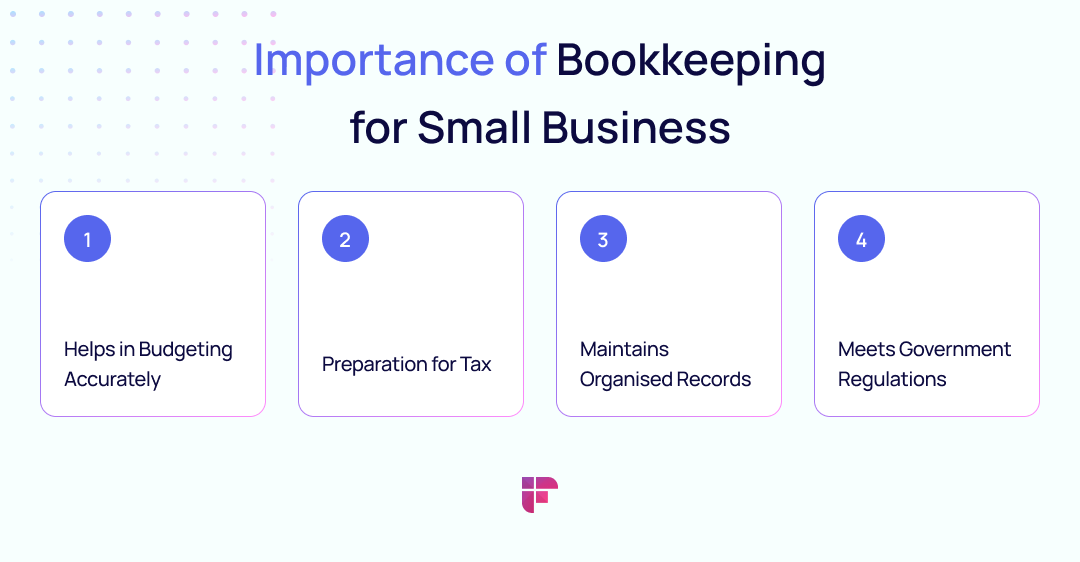

This process of managing financial records is critical while making investing, financial, and operating decisions. The importance of bookkeeping expands to the following areas as well:

- Helps in Budgeting Accurately: Efficient bookkeeping makes it seamless to create and modify budgets. With every expense and income organized and available in one place, it becomes easy to make financial decisions. A budget creates a blueprint of future expenses related to your business growth and expansion. Without having accurate books, budgeting will just be guesswork.

- Preparation for Tax: With the help of bookkeeping, you can reduce the complexity of filing taxes. You’ll have each transaction recorded. This will make it easier to figure out how much tax you’ve to pay. Bonus, the taxman will not bother you with his questions about past records.

- Maintains Organised Records: As your small business grows, it generates hundreds of pieces of information per month. If you don’t have an organized place for your records, you can’t evade last-minute stress. Bookkeeping helps you keep an eye on every movement of money so that you can understand the financial state of your business at a glance.

- Clear Business Targets: Your business won’t be able to grow if you can’t set clear business targets. Setting a smart target will require past data to draw trends and insights. By keeping clean book records, you can chalk out your business goals and propel business growth.

- Meets Government Regulations: Government keeps on updating regulations regarding taxes. Almost all new policies require you to keep your account books up-to-date. For instance, UK’s Making Tax Digital (MTD) policy requires businesses to pay taxes digitally via software or apps. This means that you don’t just have to do bookkeeping but also use accounting software to keep finances updated and automated.

- Provides Peace of Mind: The last thing you want to bother about as a business owner is messy account books. Unorganized bookkeeping can become a reason for missed deadlines, penalties, and last-minute stress. When you do bookkeeping efficiently, you can relax and not worry about missed entries and messy accounts.

How to do Bookkeeping for Small Business: Tips to Get You Started

There is nothing more unproductive than jumping into a heap of files to locate a single piece of information.

Thus, you need to execute bookkeeping for small businesses by following a defined framework. Here are the tips that can help you do bookkeeping easily and effectively:

1. Understand Different Business Accounts

In bookkeeping terms, accounts don’t refer to individual accounts. Instead, it refers to a collection of financial transactions of certain types:

- Assets: this account refers to cash and resources owned by small businesses, e.g., accounts receivable, inventory.

- Liabilities: these are the obligations and debt held by the business, e.g., accounts payable, loans.

- Revenues/ Income: money earned by small businesses, usually via sales.

- Expenses/ Expenditure: refers to the cash flow out of business to purchase a product or service, e.g., salaries, utilities.

- Equity: value remaining after subtracting liabilities from assets—represents the owner's held interest in business, e.g., stocks.

The primary bookkeeping tip for small businesses is to create necessary accounts to record every financial transaction. Every account will not be the same for every business. Thus, it’s crucial to understand the economic factors in play in your business.

2. Understand Different Business Accounts

The next step is setting up business accounts for bookkeeping. Earlier, businesses used to record transactions in physical books called general ledger (GL). Now, most companies use automated software and tools to record accounts. It’s like a virtual cash flow database—the overall file is still known as a general ledger.

There are three ways to create a virtual GL:

- Spreadsheets (Google Sheets, MS Excel)

- Desktop-Based Bookkeeping Softwares (QuickBooks Desktop)

- Cloud-Based Bookkeeping Softwares (Wave, QuickBooks Online)

Spreadsheets are the cheapest way of bookkeeping. Google Sheets is free and offers most of the features one can expect. But creating a general ledger from scratch is intimidating and time-intensive.

The next option is desktop-based software, which requires a high upfront price. But that tool is limited to some systems as it works offline.

The best option here is cloud-based bookkeeping software, where you’ve to pay a subscription fee per month and it also makes collaboration easy.

3. Record Every Transaction

Each debit and credit transaction must be fed into the system correctly and in the specific account. Else, your account balance won’t match. To record a transaction, evaluate the account that will be credited or debited.

For instance, consider you’ve purchased automation sales software worth $1500. You paid for the sales system, and it was deducted from your account.

This financial transaction would affect two accounts: debit and equipment (both being assets). You’ll record a $1,500 debit for the equipment account and a $1,500 credit for the cash account.

4. Decide Bookkeeping Account

Whether you’re doing bookkeeping in-house or outsourcing it to another agency, you need to decide on a method. Will you use single-entry bookkeeping or double-entry bookkeeping?

Here’s what each of them includes:

- Single-entry Bookkeeping: As per this method, you’ve to record every transaction only once. For instance, if your customer pays you $1,000, you only have to write it in the asset column. This method works for very simple businesses—working out of your home without any equipment or inventory.

- Double-entry Bookkeeping: This method of bookkeeping is applicable to most businesses. The rule is simple: for every record in one type of account, there will be an equal and opposite entry in another account. The two entries are debit (Dr) and credit (Cr). The Dr is recorded on the left side of the ledger, while Cr is recorded on the right side during bookkeeping.

5. Balance Account Books

When you tally your debits and credits of a specific account, the totals must match (at the end of the quarter or year); this is called balancing the books. For instance, imagine your cash account has $2,000 in debits and $3,000 in credits over the first quarter.

To balance the books, you’ve to adjust the cash account balance by $1,000.

Follow this method to balance each account in your ledger. When you combine all your accounts, you can verify your financial transactions using the equation:

If the two sides don’t match, you’ve to turn pages of your ledger to rectify the mistake.

6. Prepare Actionable Reports

The basics of bookkeeping involve transforming numbers in a book into something actionable. That’s where financial reports come in.

In short, these reports act as a summary of the financial health of your business. The type of reports you can leverage are:

- Balance Sheet: this report records your business’s assets, liabilities, and equity over a specific period. This means that your total assets should be equal to liability plus equity. The balance sheet reveals whether you need to expand your business or reserve cash.

- Profit and Loss (P&L) Statement: This report shows revenues, costs, and expenses over a period (quarter, year, etc.). Also called an income report, this statement compares sales and expenses to help you make forecasts.

- Cash Flow Statement: This statement is similar to the P&L statement, except it doesn’t include any non-cash entries (like depreciation). Cash flow reports help figure out where the business is spending, earning money, immediate viability, and financial ability to pay bills.

Opt for bookkeeping software, and you’d have the functionality of managing these reports in real-time. This is greatly beneficial for small business owners in making quick financial decisions.

7. Deploy a Bookkeeping Schedule

If you need to build an efficient bookkeeping framework, focus on setting a routine. As a rule of thumb, record all financial transactions—incoming invoices, bill payments, sales, and purchases at least once a week.

Also, close your books regularly too. You can choose to do this yearly or quarterly but on a fixed schedule.

Additionally, do bookkeeping when your mind is fresh—in the morning hours, instead of late at night. This schedule will help you map out business profitability and progress.

8. Hire Someone For Help

Bookkeeping can be complex and intimidating especially if it’s your first time. It requires the application of accounting principles which can be overwhelming.

That’s why consider getting help by hiring a bookkeeper, outsourcing to a service, or investing in robust software.

Takeaway

Bookkeeping can become challenging if you’re a small business just starting out or already in operation for years.

Of course, you can take help by hiring or outsourcing the tasks. However, it’s always effective to equip yourself with bookkeeping jargon and processes.

That way, you can understand what’s hidden behind the money numbers and make intelligent data-driven decisions.

Read Next: