The opportunity to be able to set your own salary sounds like a dream come true. But as a small business owner, you probably know that the reality is a little bit more complicated.

While signing your own paycheck seems thrilling, it comes with a lot of responsibility and includes calculated risks. Simply because there is no one answer to how much a business owner should pay themselves.

How to pay yourself as a business owner depends on a lot of factors. But most importantly, it relies on the type of business structure you have.

There are two opinions when it comes to how much salary you should draw from your small business:

Some experts think you should take only what you absolutely need to survive, while others believe your salary should be based on market value.

As a small business owner looking to start paying yourself, you need to know the arguments on both sides:

1. Paying yourself the bare minimum

The good side: Lack of cash flow is the main reason most small businesses fail. By not drawing a lot of money out of the company, you create a capital resource that you can bank upon in times of business crisis or unexpected expenditures. But of course, this can work only if you have another source of income.

The bad side: Paying yourself the bare minimum as a small business owner could potentially create an unrealistic picture of how your business is doing. Because you draw out so little every month, your business bank account increases every month, making you think you have a healthy bank account, which in actual fact is a fallacy.

This argument says that if you can't afford to pay yourself a decent income, it's time to admit that your business model isn't working.

2. Paying Yourself What You’re Worth

The good side: When you pay yourself based on your market worth, you rely on an accurate picture of your company’s financial status. This is also an important step if you’re thinking about reaching out to potential investors.

The bad side: Everything has a growth curve, and if you’re relying on your small business to fund your life sooner than it is ready to, you might be making a mistake. It’s important to analyze how your small business is maturing and wait for the right time to reap benefits. The analogy of ‘a tree gives fruits only when ready’ is a good one to make here.

How To Pay Yourself As A Business Owner?

Now that you know both sides of the argument, let’s look at what IRS says about how much you should pay yourself:

“A reasonable compensation.”

Of course, that’s extremely subjective. How do you know what that means for you as a small business owner?

The IRS states that “Wages paid to you as an officer of a corporation should generally be commensurate with your duties. Refer to “Employee’s Pay, Tests for Deducting Pay” in Publication 535, Business Expenses” for more information.

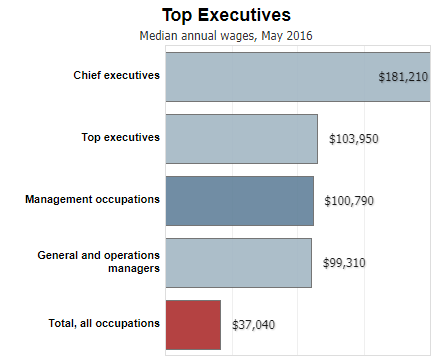

In other words, you need to give yourself a market wage.

If you’ve already reached a point in your business where you’re thinking about paying yourself, sticking to the market wage is a good idea.

If you’re not paying yourself the salary you deserve for the work you put in; you don’t have the correct idea about the health of your company. Without being able to factor in all your expenses, you will not have clarity towards your next steps ( pricing, marketing decisions, investment etc).

Having said all that, there is definitely more to it. If you’re a small business owner wondering how much to pay yourself, the following pointers should help you arrive at the right number.

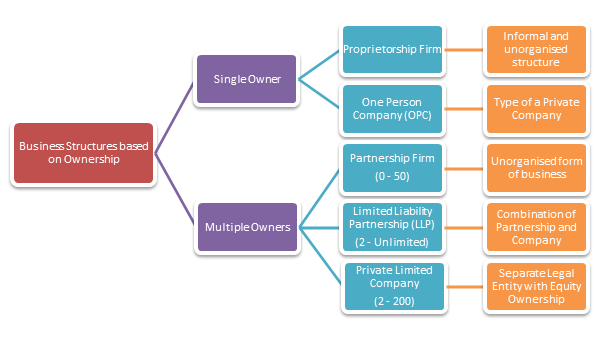

1. Take Stock of Your Corporate Structure

The structure of your business dictates how much you get paid. Here’s a breakdown to give you an idea:

- Sole proprietorship: A sole proprietorship is the easiest and least expensive business structure to establish. It gives you the maximum flexibility in terms of deciding how much you should pay yourself.

- Partnership: Needs at least 2 people, and your share of profit depends on how much ownership you have in the company as outlined in the partnership agreement. This is the next best flexible business type when it comes to deciding your own salary.

- C & S Corporation: This means that you’re legally separate from your business. C corporation business type gives you protection from losses but taxes you twice. S corporation business type makes you a shareholder and doesn't tax you twice.

- Limited Liability Company: Can be both single member or multi-member. LLCs do not pay taxes on their profits directly. Their profits and losses are passed through to members, who report them on their individual tax returns.

2. Subtract Your Business Expenses From Your Sales

Before worrying about how much to pay yourself as a small business owner, make sure your business remains afloat. Ensuring that your operating expenses (including tax estimates) are paid first will bring clarity regarding your company’s financial health.

To a large extent, a lot of your fixed expenses will be predictable (rent, website, salaries, etc). While it’s important to subtract this from your gross income, you also have to factor in variable costs before you withdraw money for yourself.

While your goal should be to withdraw a fixed amount of salary for yourself every month, remain flexible for the first few months of experimentation. One simple reason being that business taxes are dependent on how much your business is making, and it is something you can calculate on a month-to-month basis based on your earnings.

3. Factor In Employee Pay and What You Give Your Business

When paying yourself, it’s easy to underestimate the work you’re putting in. Ensure you’re doing justice to the money your company is making. Your salary should reflect the elasticity of your time investment.

In other words - don’t limit your salary because you feel your hourly earnings are more than your number two employee. Ultimately, this is your business, and the amount of time you invest in it will vary. Some weeks it could be 40, and on others 65.

So if you’re including time commitment as a factor that dictates your salary (and it should), make sure to account for the extra hours when you do the calculations.

4. Compartmentalize Your Gross Income Into Percentages

Once you’ve taken care of your fixed and variable expenditures, the net amount is the number you can withdraw your salary from. Here’s a template of how you can divide your gross business income into percentages to be able to find the right salary as a small business owner:

- Leave 20% of the money for a business emergency fund. You should be aiming for at least six months of business expenses available in this account to help in times of crisis (i.e. for unforeseen expenses, liabilities etc).

- Your taxes shouldn’t ideally take over 30% of your gross income. While how much tax you pay will depend on the money your business is making, setting healthy financial numbers will help you manage expectations and plan better for deciding the salary you deserve.

- About 20% should be put back into the business towards new projects, marketing, branding, and other business heads.

- Once you have the above cleared, take 30% of the money home as your salary. This way you’re not underpaying yourself (because you’re creating an emergency reserve) or overpaying yourself (because well, you’re creating an emergency reserve!).

💡 Fireflies Tip

Want more out of your salary as a small business owner? Implement a bonus system for you and your employees, where you earn a bonus based on how profitable the company is over the course of a year.

5. Add yourself to the payroll and pay yourself regularly

There’s no harm in being experimental with how much you pay yourself as a small business owner. The number you take home can change month-to-month based on multiple factors. But don’t dip into your business funds as and when you need to.

If you’re new to this and feel unsure about creating flexibility, take the traditional approach until you feel confident about managing your salary. Set up a payment schedule (could be weekly, or monthly) in your payroll software, and stick to it.

It’s important to build financial discipline in your business from the start, and it should reflect in the way you distribute salaries.

This will also help you create a brand image that your employees respect. Regular small payments are generally more acceptable than random, unpredictable payments.

When NOT to Pay Yourself

It can be tempting to pay yourself frequently when you see your business growing. But there could be times where you won’t be guaranteed a payment (as part of business growth, slump, unexpected taxes, new urgent resources, etc).

It’s probably best to not pay yourself when you find your business in tricky spots as mentioned above. Here are a few circumstances when you should consider not paying yourself for the sake of keeping your business healthy:

- When your business is going through a tough time financially, it’s best to not pay yourself for the time being. If anything should be sacrificed (for least risk and stakes) for a while - it should be your salary.

- If you’re struggling with paying your employees, you should hold yourself back from paying yourself. The rule remains - always clear debt (salaries owed to employees are also debts) first before you take money home.

Remember that as your business grows so will your salary, hence it is perfectly okay if your salary at first isn’t what you hoped. Following these steps while deciding how to pay yourself as a business owner will allow you to give your business structure as well as longevity so that you can eventually start receiving the paycheck you long envisioned.

Last 2 cents

Remember that your salary will grow with your business. So it is perfectly okay to take a pay cut initially. Following some of the steps above will help you pay yourself the desired salary while keeping the business up and running!