Venture capital moves fast. Between screening calls, IC meetings, portfolio check-ins, and LP updates, the documentation burden can be overwhelming. Often, VCs must serve two separate functions during meetings as both an active listener and participant in the conversation, and a diligent note-taker, saving insights for future review.

With firms conducting over 1,000 screening calls annually and holding hundreds of internal meetings, manual note-taking and memo preparation can consume 30-50% of an analyst's work hours. The cost is real: delayed decisions and lost context when deals are transferred between partners.

Today, we're launching Fireflies for VCs, a tailored solution that transforms how venture capital teams capture, analyze, and act on deal conversations.

VCs Need More Than a Generic Note-Taker

VCs don’t just want raw transcripts. They need deal-memo–style insights: founder story, traction, risks, and market size to sharpen their decision-making, and keep every deal moving forward.

A typical week stretches 50–60 hours, much of which is lost to manual note-taking, fragmented context, and CRM cleanup. And while 76% of investors already use AI for admin tasks, very few apply it directly to the investment decision-making process.

Fireflies for VCs closes that gap with specialized AI Apps, custom summary templates, and integrations built specifically for venture workflows.

Rich Summaries and Insights (not just transcription)

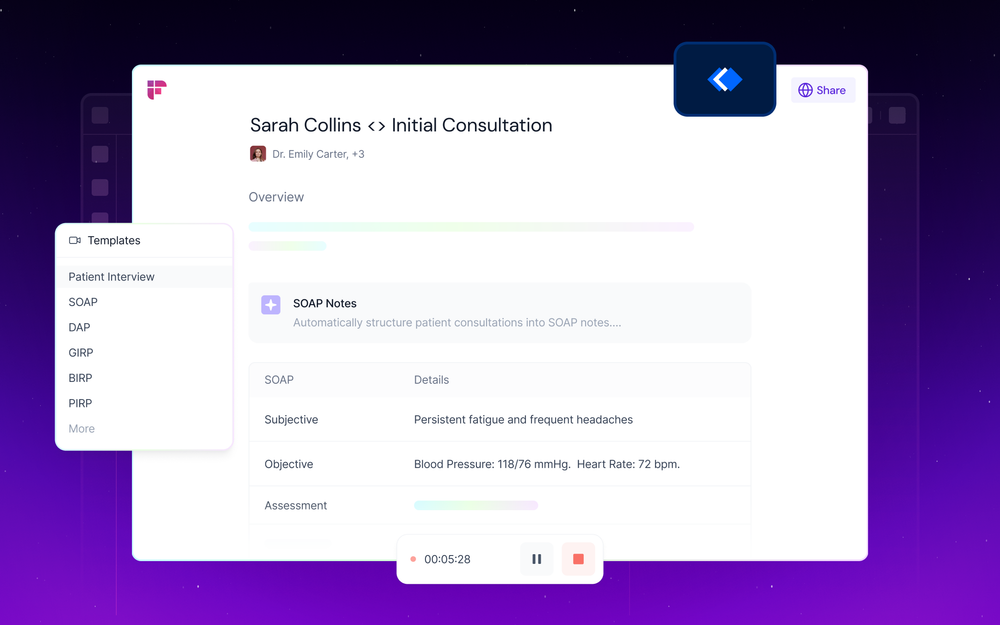

Fireflies turns every pitch, diligence call, and partner review into deal-memo-style outputs immediately after each conversation, enabling you to move faster without compromising diligence.

- Tailored Meeting Summaries: One-click templates to generate summaries for Partner Pitch, IC Meeting, and Founder Check-In, so post-call cleanup takes minutes, not hours.

- Conversation Analytics: Automatically surface conviction, sentiment, and red flags, so your judgment relies on evidence, not memory.

- AskFred Search: Pull the exact ARR figure, hiring plan, or founder quote from across all diligence, IC, and portfolio calls in seconds

A Library of VC-Specific AI Apps

Our AI Apps automatically extract the insights that matter most to investors and turn meetings into next steps and decision documents. You can choose from a library of 17+ VC-specific AI Apps, including:

- Investment Memos: Auto-generate structured deal memos from founder calls

- Founder Scorecards: Rate founders on clarity, execution, and market fit

- Red Flags Detector: Highlight risky claims, contradictions, or exaggerations

- Traction Tracker: Extract ARR, growth rate, burn, and CAC from calls

- Deal Conviction: Capture partner enthusiasm and reservations

- Co-Investor Mentions: Track all VCs, angels, and firms mentioned

- Reference Checks: Create ratings based on reference conversations

- LP Update: Turn portfolio reviews into concise LP updates.

Single Source of truth for Your CRM

Fireflies for VCs syncs notes, action items, and structured fields directly into the tools you already use, such as Affinity, Attio, HubSpot, Salesforce, Airtable, and Notion, plus over 80 other integrations (MCP Server available), so context follows the deal instead of getting lost in a document or inbox.

What this means in practice

- Associates stop copy-pasting and start qualifying.

- Partners walk into IC with a consistent memo format.

- Hand-offs don’t leak context when a deal changes owners.

The Results VCs Can Expect

- Save 5–10 hours per week per investor by automating notes, memos, and CRM updates.

- Raise decision quality with conviction tracking, red-flag detection, and founder scorecards applied uniformly across deals.

- Never lose deal context with standardized summaries and a single source of truth across partners, synced directly into your CRM.

- Build LP trust with auto-generated updates and data-driven portfolio insights.

Privacy & Security

Fireflies remains the most secure AI meeting assistant and is built with enterprise-grade security and compliance features:

- Enterprise-grade Compliance: Fireflies meets the highest security standards, including SOC 2 Type II and GDPR, ensuring your data is always protected.

- Encrypted & Auditable: All conversations are encrypted, time-stamped, and securely archived for easy audits.

- Access Controls: Set permissions so only authorized team members can view sensitive data.

- Data Policies: Choose where data is stored and how long it’s retained, with a strict zero-day vendor retention policy.

- Your Data, Your Ownership: Fireflies never uses your meeting data to train AI models. Your information stays private and secure.

Get Started Today

Fireflies for VCs is available now as part of your existing Fireflies plan. No additional cost, no lengthy setup.

Ready to transform your deal flow?

FAQs

Q1: What is Fireflies for VCs?

Fireflies for VCs is an AI meeting assistant tailored to venture capital workflows. It automatically transforms calls into deal memos, scorecards, and CRM updates.

Q2: Is Fireflies secure enough for investment discussions?

Yes. Fireflies complies with SOC 2 Type II, GDPR, and HIPAA, with end-to-end encryption and role-based access controls.

Q3: Can Fireflies integrate with our CRM?

Yes. It syncs directly with Affinity, Attio, Salesforce, HubSpot, Airtable, and Notion, ensuring no deal context is lost.

Q4: How fast are summaries generated?

Fireflies produces summaries within minutes after each call, regardless of call length.

Q5: Do analysts still need to take notes?

No. Analysts can focus on conversations, while Fireflies automatically captures and structures notes into templates.

Q6: Can we customize outputs?

Yes. You can apply custom templates for IC meetings, LP updates, or founder check-ins, tailored to your firm’s workflow.

Q7: How much time can VC teams save?

Firms typically save 5–10 hours per week per investor by automating notes, memos, and CRM updates.

Questions? Want to see a demo? Contact our team or join our next office hours to learn how VCs are using Fireflies to gain a competitive edge.